网格交易法(期货)

1. 原理

什么是网格交易法?

网格交易法是一种利用行情震荡进行获利的策略。在标的价格不断震荡的过程中,对标的价格绘制网格,在市场价格触碰到某个网格线时进行加减仓操作尽可能获利。

网格交易法属于左侧交易的一种。与右侧交易不同,网格交易法并非跟随行情,追涨杀跌,而是逆势而为,在价格下跌时买入,价格上涨时卖出。

怎样设计网格?

投资者可以随意设置网格的宽度和数量。既可以设置为等宽度,也可以设置为不等宽度的。设置等宽度网格可能会导致买点卖点过早,收益率较低。设置不等宽度网格能够避免这个问题,但如果行情出现不利变动,可能会错失买卖机会。

网格交易法的盈利情况

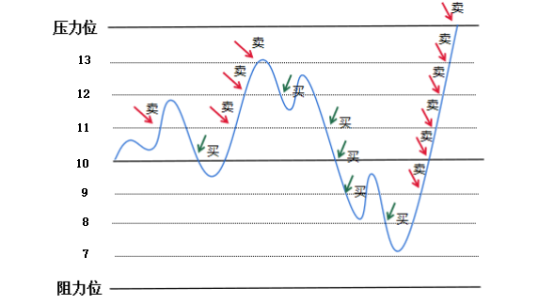

在行情震荡上涨时:

假设格子之间的差为1元钱,每变化一个格子相应的买入或卖出1手,则通过网格交易当前账户的净收益为6元,持空仓4手,持仓均价为12.5元。

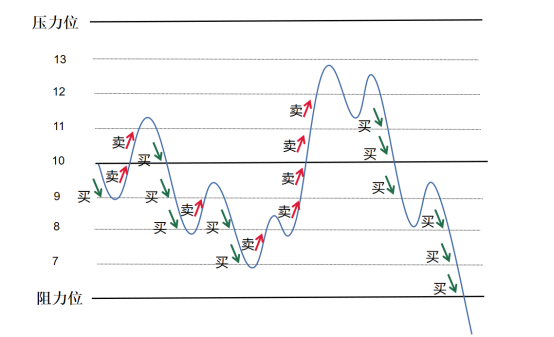

行情震荡下跌时:

同理可知,净收益为8元,持4手多仓,平均成本为7.5元。

可以看到,无论行情上涨还是下跌,已平仓的部分均为正收益,未平仓的部分需要等下一个信号出现再触发交易。

即使网格交易能够获得较为稳定的收益,但也存在一定的风险。如果行情呈现大涨或大跌趋势,会导致不断开仓,增加风险敞口。这也是为什么网格交易更适用震荡行情,不合适趋势性行情。

核心

网格交易主要包括以下几个核心要点:

- 挑选的标的最好是价格变化较大,交易较为活跃

网格交易是基于行情震荡进行获利的策略,如果标的不活跃,价格波动不大,很难触发交易。

- 选出网格的压力位和阻力位

确定适当的压力位和阻力位,使价格大部分时间能够在压力位和阻力位之间波动。如果压力位和阻力位设置范围过大,会导致难以触发交易;如果压力位和阻力位设置范围过小,则会频繁触发交易。

- 设置网格的宽度和数量

设定多少个网格以及网格的宽度可根据投资者自身喜好自行确定。

2. 策略思路

第一步:确定价格中枢、压力位和阻力位

第二步:确定网格的数量和间隔

第三步:当价格触碰到网格线时,若高于买入价,则每上升一格卖出m手;若低于买入价,则每下跌一格买入m手。

回测标的:SHFE.rb1901

回测时间:2018-07-01 到 2018-10-01

回测初始资金:10万

注意:若修改回测期,需要修改对应的回测标的。

策略难点:

- 怎样记录价格是否突破网格线?

解决方法:有些人可能会想到用当前价格与网格线对应的价格进行比较,但这样操作比较麻烦,步骤繁琐。这里采用区域判断方式。根据网格线划分网格区域为1、2、3、4、5、6.利用pandas库提供的cut函数,将当前价格所处的网格区域表示出来。当网格区域发生变化,说明价格突破了一个网格线。

- 如何避免出现4区-5区开仓一次,5区-4区又平仓一次这种“假突破”?

解决方法:4-5开仓一次和5-4平仓一次实际上突破的是一根线,此时的形态是价格沿着这根线上下波动。只有第一次穿过这条线时才是真正的交易信号,其他的并没有形成突破。因此我们需要一个变量储存每一次交易时网格区域的变化形态(按照从大到小的顺序),比如5-4可以记为[4,5],4-5记为[4,5]。当新的记录=旧的记录时,信号失效。

3. 策略代码

# coding=utf-8from __future__ import print_function, absolute_import, unicode_literalsimport numpy as npimport pandas as pdfrom gm.api import *'''本策略标的为:SHFE.rb1901价格中枢设定为:前一交易日的收盘价从阻力位到压力位分别为:1.03 * open、1.02 * open、1.01 * open、open、0.99 * open、0.98 * open、0.97 * open每变动一个网格,交易量变化100个单位回测数据为:SHFE.rb1901的1min数据回测时间为:2017-07-01 08:00:00到2017-10-01 16:00:00'''def init(context):# 策略标的为SHFE.rb1901context.symbol = 'SHFE.rb1901'# 订阅SHFE.rb1901, bar频率为1minsubscribe(symbols = context.symbol, frequency='60s')# 设置每变动一格,增减的数量context.volume = 1# 储存前一个网格所处区间,用来和最新网格所处区间作比较context.last_grid = 0# 以前一日的收盘价为中枢价格context.center = history_n(symbol= context.symbol,frequency='1d',end_time=context.now,count = 1,fields = 'close')[0]['close']# 记录上一次交易时网格范围的变化情况(例如从4区到5区,记为4,5)context.grid_change_last = [0,0]def on_bar(context, bars):bar = bars[0]# 获取多仓仓位position_long = context.account().position(symbol=context.symbol, side=PositionSide_Long)# 获取空仓仓位position_short = context.account().position(symbol=context.symbol, side=PositionSide_Short)# 设置网格和当前价格所处的网格区域context.band = np.array([0.97, 0.98, 0.99, 1, 1.01, 1.02, 1.03]) * context.centergrid = pd.cut([bar.close], context.band, labels=[1, 2, 3, 4, 5, 6])[0]# 如果价格超出网格设置范围,则提示调节网格宽度和数量if np.isnan(grid):print('价格波动超过网格范围,可适当调节网格宽度和数量')# 如果新的价格所处网格区间和前一个价格所处的网格区间不同,说明触碰到了网格线,需要进行交易# 如果新网格大于前一天的网格,做空或平多if context.last_grid < grid:# 记录新旧格子范围(按照大小排序)grid_change_new = [context.last_grid,grid]# 几种例外:# 当last_grid = 0 时是初始阶段,不构成信号# 如果此时grid = 3,说明当前价格仅在开盘价之下的3区域中,没有突破网格线# 如果此时grid = 4,说明当前价格仅在开盘价之上的4区域中,没有突破网格线if context.last_grid == 0:context.last_grid = gridreturnif context.last_grid != 0:# 如果前一次开仓是4-5,这一次是5-4,算是没有突破,不成交if grid_change_new != context.grid_change_last:# 更新前一次的数据context.last_grid = gridcontext.grid_change_last = grid_change_new# 如果有多仓,平多if position_long:order_volume(symbol=context.symbol, volume=context.volume, side=OrderSide_Sell, order_type=OrderType_Market,position_effect=PositionEffect_Close)print('以市价单平多仓{}手'.format(context.volume))# 否则,做空if not position_long:order_volume(symbol=context.symbol, volume=context.volume, side=OrderSide_Sell, order_type=OrderType_Market,position_effect=PositionEffect_Open)print('以市价单开空{}手'.format(context.volume))# 如果新网格小于前一天的网格,做多或平空if context.last_grid > grid:# 记录新旧格子范围(按照大小排序)grid_change_new = [grid,context.last_grid]# 几种例外:# 当last_grid = 0 时是初始阶段,不构成信号# 如果此时grid = 3,说明当前价格仅在开盘价之下的3区域中,没有突破网格线# 如果此时grid = 4,说明当前价格仅在开盘价之上的4区域中,没有突破网格线if context.last_grid == 0:context.last_grid = gridreturnif context.last_grid != 0:# 如果前一次开仓是4-5,这一次是5-4,算是没有突破,不成交if grid_change_new != context.grid_change_last:# 更新前一次的数据context.last_grid = gridcontext.grid_change_last = grid_change_new# 如果有空仓,平空if position_short:order_volume(symbol=context.symbol, volume=context.volume, side=OrderSide_Buy,order_type=OrderType_Market,position_effect=PositionEffect_Close)print('以市价单平空仓{}手'.format(context.volume))# 否则,做多if not position_short:order_volume(symbol=context.symbol, volume=context.volume, side=OrderSide_Buy,order_type=OrderType_Market,position_effect=PositionEffect_Open)print('以市价单开多{}手'.format(context.volume))# 设计一个止损条件:当持仓量达到10手,全部平仓if position_short == 10 or position_long == 10:order_close_all()print('触发止损,全部平仓')if __name__ == '__main__':'''strategy_id策略ID,由系统生成filename文件名,请与本文件名保持一致mode实时模式:MODE_LIVE回测模式:MODE_BACKTESTtoken绑定计算机的ID,可在系统设置-密钥管理中生成backtest_start_time回测开始时间backtest_end_time回测结束时间backtest_adjust股票复权方式不复权:ADJUST_NONE前复权:ADJUST_PREV后复权:ADJUST_POSTbacktest_initial_cash回测初始资金backtest_commission_ratio回测佣金比例backtest_slippage_ratio回测滑点比例'''run(strategy_id='strategy_id',filename='main.py',mode=MODE_BACKTEST,token='token_id',backtest_start_time='2018-07-01 08:00:00',backtest_end_time='2018-10-01 16:00:00',backtest_adjust=ADJUST_PREV,backtest_initial_cash=100000,backtest_commission_ratio=0.0001,backtest_slippage_ratio=0.0001)

4. 回测结果和稳健性分析

设定初始资金10万,手续费率为0.01%,滑点比率为0.01%。回测结果如下图所示。

回测期间策略累计收益率为4.16%,年化收益率为16.50%,基准收益率为0.91%,整体跑赢指数。最大回撤为0.72%,胜率为100%。在2018年7月12日以后,标的没有交易,说明此时标的价格已经超过设置的网格范围,可以适当加宽或增加网格数量。

为了检验策略的稳健性,保持标的和回测期不变,改变网格间隔和网格数量,得到回测结果如下表所示。

| 网格间隔 | 网格数量 | 手续费 | 年化收益率 | 最大回撤 | 胜率 | 未平头寸 |

|---|---|---|---|---|---|---|

| 0.01*价格中枢 | 6 | 50.55 | 16.50% | 0.72% | 100% | 0手多单 |

| 0.02*价格中枢 | 6 | 36.89 | 26.21% | 7.82% | 100% | 2手空单 |

| 0.005*价格中枢 | 6 | 61.42 | -30.24% | 22.04% | 85.71% | 3手空单 |

| 0.01*价格中枢 | 4 | 18.11 | 15.49% | 4.17% | 100% | 1手多单 |

| 0.02*价格中枢 | 4 | 18.16 | 16.08% | 4.16% | 100% | 1手空单 |

| 0.005*价格中枢 | 4 | 21.72 | -51.27% | 31.39% | 100% | 4手空单 |

可以看到,改变网格间隔和网格数量对回测结果的影响较大。整体胜率较高,但存在部分未平头寸。在网格间隔设置为0.01倍价格中枢时,整体收益率最高,最大回撤也处于较低水平;在网格间隔为0.02倍中枢价格时,整体收益率最差。由此可以看出,网格间隔对收益率的影响要高于网格数量。因此,在利用网格交易法时,需要设置合理的网格间隔。

注:此策略只用于学习、交流、演示,不构成任何投资建议。